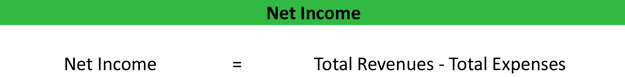

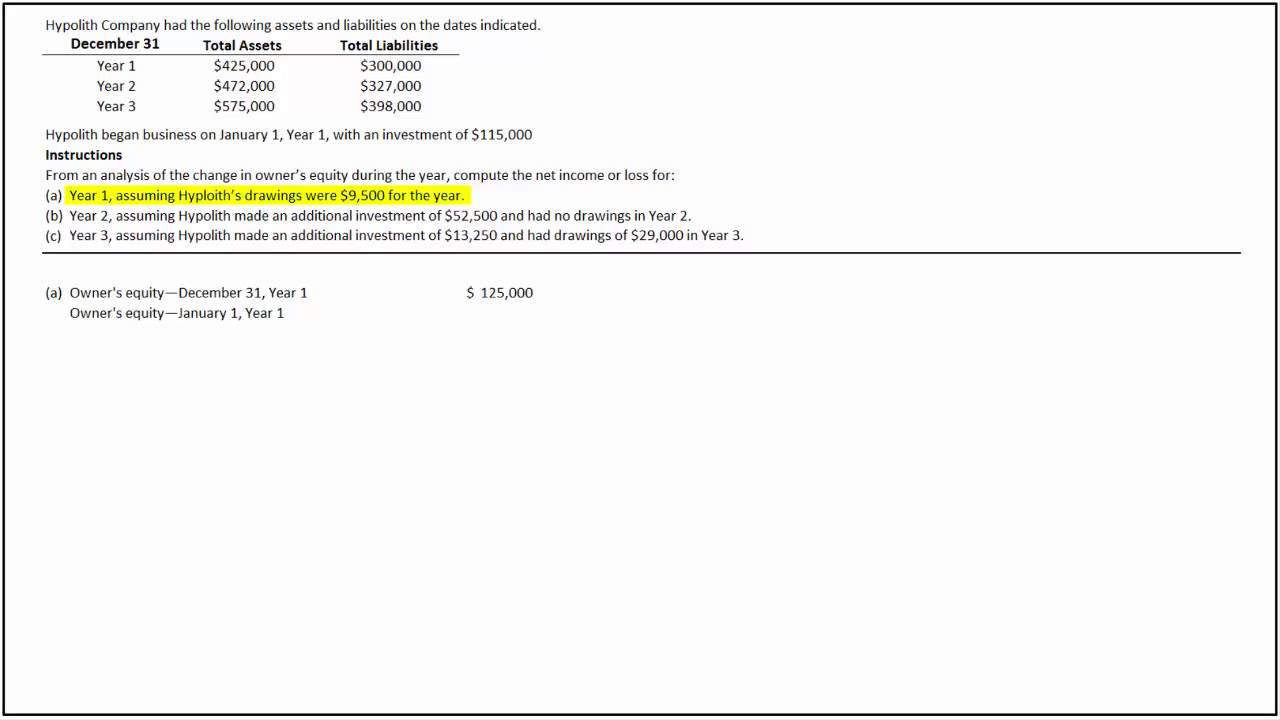

Preliminary net income formula

The bill implements a new minimum tax on large corporations book income limits a tax preference for carried interest income and reduces government outlays on prescription drugs through several pricing reforms. Seek to replicate a specific index.

Net Income Formula And Calculation Example

In the third quarter real GDP increased 334 percent.

. To provide a platform for discussion of current ideas in urologic education patient engagement. Customer you still have to make payments on your debt. The requirement of what the net income from the sale use lease or lease renewal of real property acquired can be used for is consistent with 23 USC.

Led by private wages and salaries proprietors income both nonfarm and farm personal income receipts on assets and rental income table 8. You have a stream of income MRR ACS paying off a portion of the total CAC ie. Estimated Property Price 120000 x 5 units 600000.

Businessfarm income You should include total business or farm net income before adjusting for depreciation andor losses. Real gross domestic product GDP increased at an annual rate of 40 percent in the fourth quarter of 2020 table 1 according to the advance estimate released by the Bureau of Economic Analysis. There are two ways in which we calculate the Cash Flow From Operations.

The Cash Flow from Operations in the Cash Flow Statement represent Cash transactions that have to do with a companys core operations and is therefore an extremely important measure of the health of a Business. The funding awards 111 projects bringing the programs total funding to 546 million. In this brief PWBM offers a preliminary analysis of the budgetary and macroeconomic effects of the bill.

Businessfarm income is normally found on Schedules C andor F. Real disposable personal. Combined Monthly Net Income obligors line 4 plus obligees line 4.

The sample size for collecting quantitative data from three tertiary care hospitals for this research had been calculated by using the simplified Yamane formula 1967 as found in previous. Why is churn important. A Applicability of the Support Guidelines.

The Cash Flow Statement - Direct Method. 191016-2 and the number of persons being supported. The rent-to-income ratio is a formula used to measure a renters ability to pay rent and is calculated by dividing rent by the renters income stated as a percentage.

The formula used to compute these income limits is as follows. 10 percent of monthly income. Do not calculate income limit percentages based on a direct arithmetic relationship with the median family income.

The formula used in determining the TTP is the highest of the following rounded to the nearest dollar. Flat rents which are set at 80 of fair market. We compute the average annual growth of program expenses using the following formula.

Monthly Adjusted Income is annual income less deductions allowed by the regulations. You should also examine each partnership or corporation eg. The mission of Urology the Gold Journal is to provide practical timely and relevant clinical and scientific information to physicians and researchers practicing the art of urology worldwide.

First find your gross annual rental income and then input the income and GRM into the estimated property price formula. A For taxable years beginning after 1994 a tax is imposed on the South Carolina taxable income of individuals estates and trusts and any other entity except those taxed or exempted from taxation under Sections 12-6-530 through 12-6-550 computed at the following rates with the. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the. IRS forms 1120 1120S or 1065 in which you have an interest. If you lose that stream of income ie.

Think of the payback period like debt repayments as mentioned above. Y n Y 0 1n-1 where Y 0 is a charitys program expenses in the first year of the interval analyzed Y n is the charitys program expenses in the most recent year and n is the interval of years passed between Y 0 and Y n. This week AMS announced an additional 219 million for grant projects through the Meat and Poultry Inspection Readiness Grant Program.

ETFs are bought and sold through an exchange at the then current market price not net asset value NAV and are not individually redeemed from. The explanation of use for the program income or revenue earned from the operation of an EV charging station mimics the limitations on use of revenues for toll roads bridges tunnels. Estimated Gross Rental Income Property Price Gross Rent.

30 percent of the monthly adjusted income. Capital Group Core Plus Income ETF Fund 40306 CGCP seeks to provide current income and seek maximum total return consistent with preservation of capital. Take 120 percent of the Very Low-Income Limit.

To promote equity and diversity among authors reviewers and editors. Importance of Rent-to-Income Ratio why its used its benefits and its. 1 Except as provided in subdivision a3 the support guidelines determine a spouses or parents support obligation based on the parties combined monthly net income as defined in PaRCP.

For example if the rent is 500month and the renter earns 2000month their rent to income ratio would be 25. This is an important distinction because it allows you to understand the ratio from two different points of view. In the case of fiduciary actions which are subject to Part 4 of Subtitle B of Title I of ERISA 29 USC.

The first formula shows us directly what is taken out of earnings while the second equation shows us what must be added back into net income. Tax rates for individuals estates and trusts for taxable years after 1994. 1101 et seq the Secretary of the Treasury shall notify the Secretary of Labor prior to the time of commencing any proceeding to determine whether the action violates the exclusive benefit rule of subsection 401a of the Code 26 USC.

There are too many exceptions made to the arithmetic rule in computing income limits. Disposable personal income increased 2914 billion or 66 percent in the second quarter in contrast to a decrease of 588 billion or 13 percent in the first quarter. The first is more of a preliminary operations point of view.

Your gross annual rental income would be 2000 x 5 units x 12 months 120000. Conversion to Monthly Net Income if pay period is other than monthly Include the childs monthly Social Security derivative benefit amount if any in the monthly net income of the party receiving the benefit pursuant to PaRCP. This is the hidden cost of churn.

For US tax filers.

Net Income Formula Calculator Definition

Net Income Formula Calculator Definition

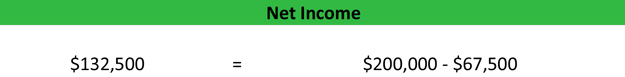

How To Determine Net Income Or Loss Accounting Accounting Principles Youtube

The Top How To Get Net Income From Trial Balance

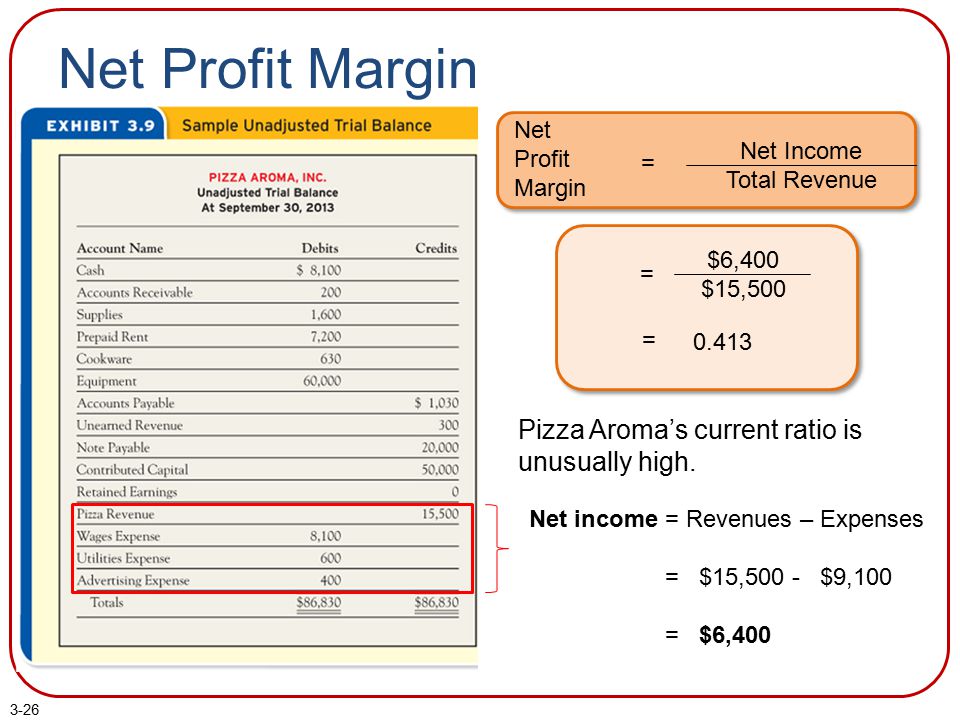

Net Profit Margin Formula And Ratio Calculator Excel Template

Chapter 3 The Income Statement Powerpoint Authors Brandy Mackintosh Ppt Download

Net Income Formula And Calculation Example

Chapter 3 The Income Statement Powerpoint Authors Brandy Mackintosh Ppt Download

How To Calculate Net Income Formula And Examples Bench Accounting

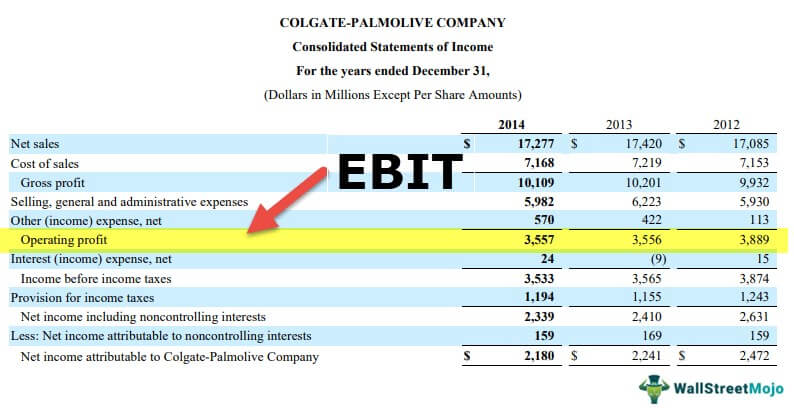

Ebit Earnings Before Interest Taxes Meaning Examples

Solved I Can T Figure Out The Preliminary Net Income Can Chegg Com

Net Profit Margin Formula And Ratio Calculator Excel Template

Solved Determine Qci S Preliminary Net Income Chegg Com

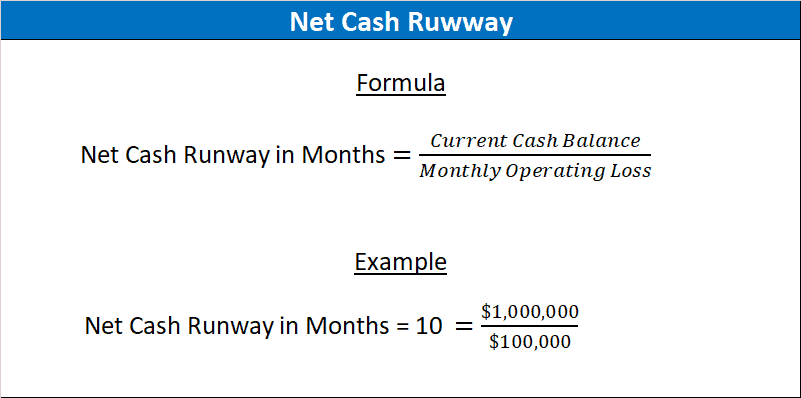

How To Calculate Your Cash Burn Rate The Saas Cfo

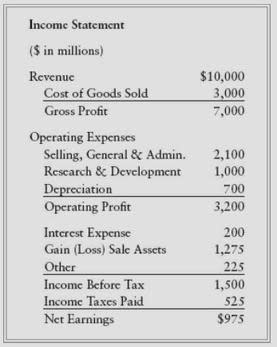

Buffett On Financial Statements The Income Statement

Solved I Can T Figure Out The Preliminary Net Income Can Chegg Com

Pro Forma Definition